Fintech and Household Resilience to Shocks: Evidence from Digital Loans in Kenya

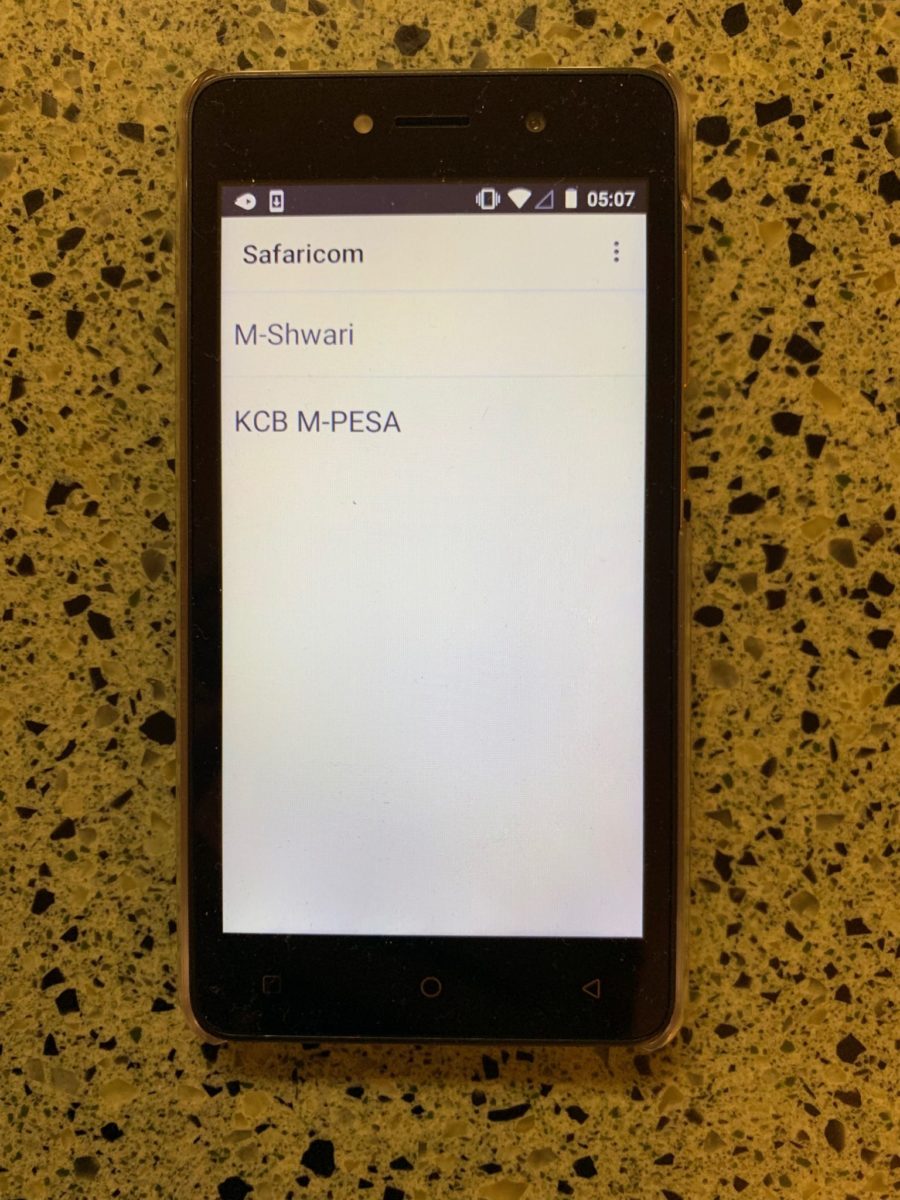

On May 6th, 2020 CEGA’s Digital Credit Observatory (DCO) hosted a webinar with Prashant Bharadwaj: Fintech and Household Resilience to Shocks: Evidence from Digital Loans in Kenya. CEGA Affiliate Prashant Bharadwaj (University of California, San Diego) presented joint work with William Jack and Tavneet Suri, “Fintech and Household Resilience to Shocks: Evidence from Digital Loans in Kenya” and other related studies.

The DCO maintains a strong network of private sector, academic, and policy partners working on digital credit, producing a quarterly newsletter. If you wish to receive our newsletter and receive invitations to future webinars, please sign up for the DCO newsletter here.

We’re interested to engage in this time of working remotely, using digital formats that help us collaborate and disseminate research among a broader set of stakeholders as we continue to produce results through 2021. Please let us know if you have any feedback or suggestions based on this webinar. We look forward to being in touch if you have any questions or ideas for collaboration.

The DCO was established in 2016 with support from the Bill and Melinda Gates Foundation to support a coordinated portfolio of rigorous research on the impacts—both positive and negative—of digital credit products in emerging markets, and the effectiveness of related consumer protection measures. In addition to funding research, the DCO maintains a strong network of private sector, academic, and policy partners working on digital credit for the purposes of sharing information and identifying meaningful areas of collaboration. Once our funded research studies have results, we hope to host more webinars and events to share what we’ve learned.